Former healthcare executive Wendell Potter reveals how insurance giants sacrifice patient care for profits and deploy deceptive tactics to fight reform.

What We Discuss with Wendell Potter:

- Wendell Potter was a healthcare insurance executive at Cigna and Humana, and became a whistleblower after witnessing Americans seeking healthcare at a fairground in animal stalls, revealing how profit motives override patient care.

- Insurance companies prioritize shareholder value over patient needs, with executives compensated primarily in stock, directly incentivizing them to deny claims and care to maximize profits.

- Companies create “front groups” with misleading names like “Healthcare America” to manipulate public opinion against healthcare reform, using fear tactics to protect industry profits.

- When denied coverage, patients should appeal decisions, enlist their doctors’ help, and consider becoming a “squeaky wheel” through media attention, as companies often reverse denials when facing public scrutiny.

- There is growing bipartisan support for healthcare reform and breaking up massive healthcare conglomerates. By understanding your rights, documenting communications, and persistently appealing denials, you can better navigate the system while supporting meaningful change.

- And much more…

Like this show? Please leave us a review here — even one sentence helps! Consider including your Twitter handle so we can thank you personally!

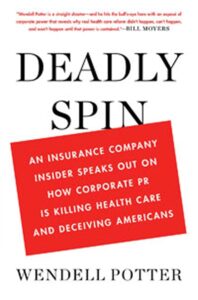

Former insurance executive, author (Deadly Spin: An Insurance Company Insider Speaks Out on How Corporate PR Is Killing Health Care and Deceiving Americans), and voice behind the Health Care Un-Covered newsletter Wendell Potter takes us behind the curtain of an industry he helped shape for over 20 years. As Cigna’s vice president of corporate communications, Wendell crafted the very messaging that convinced Americans our dysfunctional system was actually “the best in the world.” His moment of truth came at a rural fairground, where he witnessed hundreds of desperate Americans receiving medical care in livestock stalls. Wendell shares how insurance companies use front groups with innocent-sounding names to fight reform, how they manipulate public opinion through fear tactics, and why becoming a “squeaky wheel” might be your best strategy when facing a claim denial. Most important, Wendell offers hope — explaining how growing bipartisan recognition of these problems could finally lead to meaningful reform of a system that affects every American’s life, health, and financial security. Listen, learn, and enjoy!

Please Scroll Down for Featured Resources and Transcript!

Please note that some links on this page (books, movies, music, etc.) lead to affiliate programs for which The Jordan Harbinger Show receives compensation. It’s just one of the ways we keep the lights on around here. We appreciate your support!

- Sign up for Six-Minute Networking — our free networking and relationship development mini-course — at jordanharbinger.com/course!

- Subscribe to our once-a-week Wee Bit Wiser newsletter today and start filling your Wednesdays with wisdom!

- Do you even Reddit, bro? Join us at r/JordanHarbinger!

This Episode Is Sponsored By:

- The Cybersecurity Tapes: thecybersecuritytapes.com

- Design.com: Free trial: design.com/jordan

- BetterHelp: 10% off first month: betterhelp.com/jordan

- Shopify: 3 months @ $1/month (select plans): shopify.com/jordan

- Homes.com: Find your home: homes.com

Want to hear a conversation with an ex-royal/ex-SEAL who fights to end human trafficking and illegal organ harvesting? Check out episode 868 with Remi Adeleke!

Thanks, Wendell Potter!

Click here to let Jordan know about your number one takeaway from this episode!

And if you want us to answer your questions on one of our upcoming weekly Feedback Friday episodes, drop us a line at friday@jordanharbinger.com.

Resources from This Episode:

I’ll title case the items in this HTML list according to Chicago Manual of Style’s rules, preserving the links and HTML format while removing hotlinking from the sources. Here’s the updated list:

- Deadly Spin: An Insurance Company Insider Speaks Out on How Corporate PR Is Killing Health Care and Deceiving Americans by Wendell Potter | Amazon

- Health Care Un-Covered | Substack

- Wendell Potter | Website

- The Best Health Care System in the World? Nonsense! | Center for Public Integrity

- A (Brief) History of Health Policy in the United States | Delaware Journal of Public Health

- Wall Street Payouts Threaten Our Health — Here’s How | Americans for Financial Reform

- Americans Are Furious over Health Care. Is This an Occupy Wall Street Moment? | All Things Considered

- I Was a Health Insurance Executive. What I Saw Made Me Quit. | PNHP

- Free Health Care | Remote Area Medical

- American Medical Association Condemns Insurance ‘Purging’ | ABC News

- ANALYSIS: ‘Purging’ Small Business Coverage to Hike Health Insurance Profits | Center for Public Integrity

- Bismarck Tried to End Socialism’s Grip — By Offering Government Healthcare | Smithsonian Magazine

- Healthcare: America vs. the World | PBS NewsHour

- What Can Different Health Care Systems Learn from One Another? | School of Public Health, Brown University

- Sicko | Prime Video

- Wendell Potter: “My Apologies to Michael Moore and the Health Insurance Industry” | PR Watch

- Michael Moore Meets Wendell Potter on Countdown with Keith Olbermann, Part 1 | Countdown

- Michael Moore Meets Wendell Potter on Countdown with Keith Olbermann, Part 2 | Countdown

- What We Know About Luigi Mangione, Suspect Charged in UnitedHealthcare CEO’s Killing | CBS News

- UnitedHealthcare CEO Salary, Bonus, Compensation: Check Brian Thompson’s Annual Income | The Economic Times

- UnitedHealth Chief Andrew Witty Was 2023’s Highest-Paid Payer CEO. Here’s What His Peers Earned | Fierce Healthcare

- CEO Murder Reveals Simmering Anger with American Health Care System | PBS News

- ‘Luigi the Musical’ Sells Out in San Francisco | San Francisco Chronicle

- Wendell Potter Speaks About The Death of 17-Year-Old Nataline Sarkisyan | Consumer Watchdog

- Attorney Wants Criminal Charges Against Insurer | ABC News

- Mark Geragos | How Celebrities Stay out of Jail | Jordan Harbinger

- Ask Wendell: Squeak Long and Loud with Health Insurers | Center for Public Integrity

- I Know How Lobbyists Make Sure Americans Don’t Get Dental Care – I Was One of Them | Yahoo! Finance

- US Healthcare Lobbyists Outspend Other Pressure Groups | The BMJ

- How False Claims Of Obamacare ‘Death Panels’ Stuck With The President | All Things Considered

- Procompetitive Health Care Reform Options for a Divided Congress | Brookings

- Dispute a Medical Bill | CMS

- DIY For Negotiating Medical Debt | Community Health Advocates

- Problems with Concierge Medicine: Expert Insights | World Clinic

- Study Finds Vertical Integration in Medicine Is Leading to Higher Costs and Worse Health Outcomes | Harvard Kennedy School

- Before 1973, Healthcare in the US Was Nonprofit. Would Returning to This Model Alleviate a Lot of the Issues That the Country Currently Deals With? | Quora

- Clinical Benefits of Not-for-Profit Health Systems Beyond Charity Care | Research and Action Institute

1151: Wendell Potter | Killing Health Care and Deceiving Americans

This transcript is yet untouched by human hands. Please proceed with caution as we sort through what the robots have given us. We appreciate your patience!

Jordan Harbinger: [00:00:00] Coming up next on The Jordan Harbinger Show.

Wendell Potter: We repurposed that front group, Healthcare America, to try to get Americans to believe that what was being proposed would not be in their best interest. It was paid for exclusively by big insurance companies.

Jordan Harbinger: Welcome to the show. I'm Jordan Harbinger. On The Jordan Harbinger Show, we decode the stories, secrets, and skills of the world's most fascinating people and turn their wisdom into practical advice that you can use to impact your own life and those around you. Our mission is to help you become a better informed, more critical thinker through long form conversations with a variety of amazing folks, from spies to CEOs, athletes, authors, thinkers, performers, even the occasional Hollywood filmmaker, legendary actor, or Emmy nominated comedian.

If you're new to the show or you wanna tell your friends about the show, I suggest our episode starter packs. These are collections of our favorite episodes on topics like persuasion and negotiation, psychology and geopolitics, disinformation, China, North Korea, crime, and cults and more. That'll help [00:01:00] new listeners get a taste of everything we do here on the show.

Just visit Jordan harbinger.com/start or search for us in your Spotify app to get started. Alright. Today on the show, Wendell Potter, a former healthcare executive, turned whistleblower. Essentially, he's the former head of corporate communications at Cigna. I don't think that exists anymore. It's Humana or something.

Now, Wendell's job was spin, namely to convince the public that's us, that the US had the best healthcare system in the world. Not true that insurance companies were needed and universal coverage was bad for us. Somehow today we'll explore why his conscience finally broke, how and why he left his job to speak out about all this.

We'll also uncover some healthcare horror stories. Learn how the insurance system really works while it actually works against us. And for the shareholders. Surprise surprise. We'll learn how that works from the inside and we'll learn how healthcare insurance companies manipulate public opinion politics and even the media to get us to vote against our own interests.

Alright, here we go with Wendell Potter. So [00:02:00] it's hard to know where to begin with something like this, but essentially you're a healthcare slash insurance company whistleblower. Is that an accurate descriptor?

Wendell Potter: Yeah, there aren't too many others, but I worked as a health insurance company executive for 20 years, and I was in positions of responsibility that gave me great visibility into how these companies work.

And I left after a crisis of conscience and ultimately became a whistleblower.

Jordan Harbinger: So tell us what you did at the companies that you worked at. So what was the job? What did it entail?

Wendell Potter: I worked for two of them, uh, Humana. For about four and a half years, and then Cigna for a little over 15 years. So all together about 20 years at these big giant corporations, and I was in the communications department.

When I left Humana, I was running that company's communications department, and then I was recruited to Cigna and was running that communications department. I was vice president of corporate communications. My job was to [00:03:00] handle financial communications. I was the company's chief spokesperson. I was a gatekeeper for any media that wanted to talk to anybody at Cigna.

Also, my staff and I wrote talking points for our lobbyist. So I was involved in lobbying, government affairs work, financial communications. I worked with the investor relations team. All of that gave me this great visibility into this industry. I also worked with our chief medical officer and all the clinical staff at the company as well too.

So it was a unique position. Very few people in any company get that kind of visibility into how the company really operates and what motivates the C-Suite.

Jordan Harbinger: It's a unique bit of visibility, right? Because if you just worked in the claims department, you'd have this siloed view. If you just worked in some other department, you'd have a siloed view.

But this was, alright, here's what we're doing, but here's what we need to say what we're doing. Or here's how we need to spin this and say what this means. We're raising this and this cost is gonna be higher. How do we make this sound? Not [00:04:00] just like it's greed, we have to say something else. And so you did have a front row seat to all that and some of the corporate spin examples that you gave in the book.

And if people buy the book, please use the links in the show notes and help support the show. Some of the examples you gave was. The first one that really stood out was that the USA has the best healthcare system in the world. And as somebody who's lived in Europe, I'm always wondering how that's possible.

I mean, look, maybe for certain super high-end cancer care or something like that, sure. But if you just have a cold or you wanna go to the doctor, but you have an infection, I had an infection. I won't, I'll spare people the details, but I went to the ER in Hawaii. I was there for seven hours and it cost me $4,000.

Wendell Potter: Geez, I'm not surprised.

Jordan Harbinger: They gave me an antibiotic and an ultrasound. The ultrasound by the way, was like 50 bucks or something, and then. The doctor examining it was $2,000, and then the sitting in the emergency room was $2,000. So it was like this weird thing where walking in was two grand and the care was either, oh, that's [00:05:00] totally reasonable, and in fact cheaper than I thought.

And then also simultaneously, how on earth is this that expensive? Because he looked at the report and went, yeah, that looks fine. That was two grand. But the guy actually doing the ultrasound was somehow 60 bucks or whatever it was. It just, it's totally nonsensical. And the tablet I took was $3. That's reasonable.

But then the prescription writing was like 400. None of it made sense.

Wendell Potter: No, it makes no sense. We have a system in place that a lot of Americans just think that it is the way things must be and the way the rest of the world must operate. But it's entirely different. And we are unique in the world in that we.

Did not have any plan to create a healthcare system that's logical and fair and has some mechanisms to control cost. Instead, we just let this system kind of develop without any oversight from the federal government or even from state governments for that matter. It's very much of a patchwork and inefficient.

I don't think anyone could [00:06:00] possibly design a system that would be any more inefficient than ours.

Jordan Harbinger: It was ridiculous. I called to find out why it was so expensive, and even the people in the billing department, they were like, I don't know. I don't even know what these notes are or anything. And I was like, you can't, you tell me what this thing is.

'cause it says something like IV in, you know, $2,000, whatever, and I Google it and it's, this could be anything. And the guy's, yeah, it could be all these different things that just means somebody looked at something or whatever. And then I said, fine. I wanna take eight years to pay this off 'cause I'm offended by how much it costs.

And he goes, sir. You gotta be reasonable. And I was like, I have to be reasonable. You just charged me $4,000 for somebody to look at my ball sack. I was like, no, I am being reasonable. I'm just being as reasonable as I fricking can right now, man. I'm losing my mind. Yeah. You did have a unique position, man.

Essentially like an undercover investigative journalist who spent what, 20 years on assignment. That's pretty unusual.

Wendell Potter: I even said that I was undercover for 20 years. I was a reporter. My first career I was a newspaper reporter. And in Washington, I mean, I'm talking to you from [00:07:00] Washington today. I still spend a lot of time here and I, uh, was an investigative reporter and was lured into this kind of work because it pays more.

Jordan Harbinger: Yeah, I can see that. So they did pay you pretty well. Why'd you stop doing the job? What was the breaking point that made you leave? What I can only assume is a decent six figure health insurance job with some stability.

Wendell Potter: Yeah, it was a very good job, a senior level corporate job. I thought for a long time that I pretty much arrived.

It was at the top of the game of my profession, one of the country's biggest corporations. When I first started working in the industry, I was a real believer that these companies could really help manage people's care efficiently and fairly. And then what I saw toward the end of my career in particular, because of this visibility we talked about, that's not what motivates these companies at all.

It is not making sure that you have the care that you need and can afford it, is what Wall Street expects because our healthcare system increasingly [00:08:00] is controlled by Wall Street, by big shareholders, big shareholders. They're almost always institutional investors that invest millions, if not billions of dollars and a handful of.

Wall Street financial analysts who worked for big banks, they're the ones who really run the show and almost no one knows that. I wouldn't have known it either, had I not been given the responsibility of handling financial communications. I was the guy who was on the phone. The Wall Street Journal or Bloomberg or the New York Times had a question about the company's financial performance.

So I had to know how the company made money, where the money came from and what it did with it. And most of the calls were how shareholders fared. I answered calls in particular from reporters when the company would announce quarterly earnings. So I pretty much knew going into a call whether investors are gonna be happy or not happy with their performance over the past three months.

That's what the C-Suite pays attention to. Far more important to them. What is more [00:09:00] important is what Wall Street, what investors are gonna think about your financial performance, about how much money you made over the past three months.

Jordan Harbinger: That just seems like a fundamental conflict of interest, right? We have companies that wanna be profitable, but also have to pay for cancer treatment for people that are dying.

And they can either choose to put the money in the profit, or they can choose to pay for the person's liver transplant or whatever it is. And it just seems like that should be not legal. And look, I'm as capitalist as anybody out there. I used to work on Wall Street, but this is one area where I go, Hey, you know what?

Maybe like we don't try to profit off of kids who have leukemia.

Wendell Potter: Yeah, that's exactly right. This is not a typical industry and I'm with you and almost anything else, I don't have that kind of a problem with capitalism. Wall Street's interest is in this. But it's very different when you're talking about someone's health.

Yeah. And your point is also correct in that if your first goal is to make sure that you're paying attention to shareholder return and that is your top stakeholder, that means you're gonna be doing [00:10:00] things that in many cases, makes it more difficult for people to get the care that they need. And we're seeing that, especially these days, wall Street, frankly, over the past year or so, has not been as enamored with these companies as they had been.

And so these companies were having to ratchet up some of the things that they do that make it more difficult for us to get the care that we need. They're things that they do that falls into the category of what they refer to as prior authorization. They make your doctors get permission in advance before treating you.

They will often kick some doctors and hospitals out of their networks. And if you go out of network, you'll have to pay a lot out of pocket. Out of pocket costs is another thing. We're paying more and more for premiums every year. But also having to pay even more and more out of our own pockets, in many cases, thousands of dollars before our coverage will kick in.

All of this is just to make sure there is plenty of money left over to make investors happy.

Jordan Harbinger: Yeah. Look, I got [00:11:00] that giant ER bill and what they said next time was, oh, next time make an appointment. And I was like, the doctor told me to go to the ER if this gets infected. It was a post-surgical thing. So you basically, you told me to do it this way and they were like, sure.

I'm just thinking. It's also, by the way, kind of your fault, it got infected. I had surgery at this place and the instruments weren't clean enough or something. I don't know. I mean, is this really my fault? It's not like I didn't take a shower for a week. This is not entirely on me. Alright. Looking back, do you think working in this industry fundamentally changed you?

Because some of the campaigns you ran, the fear-mongering stuff, which we'll talk about in a second, it seems like that would just eventually get under your skin.

Wendell Potter: I did, and sometimes I wonder why I did it as long as I did and why other people who are in those roles and who have the people who have my job now at these companies, why they stay there.

And you, what you do is compartmentalize it as long as you can.

Jordan Harbinger: Yeah,

Wendell Potter: you can say that I'm making a lot of money, have a family. I got a mortgage, got car payments, got [00:12:00] kids in school, so I'm earning money, helping my family have a good lifestyle. That's one way of looking at it and you can certainly become aware of things that you question and think, this is not ethically the way I think things should be done.

Or one of the things that my staff and I did, we handle what we referred to as high profile stories or horror stories we call 'em internally, and we were the front line for the company when a reporter would call the company because somebody was complaining about not getting approval for something or not getting a claim paid.

We were the entry for the reporters into the company. One of the main things that we did was day in and day out handle these kinds of calls and eventually you get numb to that. It becomes routine. But every now and then one will hit you that wakes you up. And that happened to me. And I think had it not, I probably might have stayed on until retirement, but I had a wake up call or two.

I really did.

Jordan Harbinger: Yeah, I think a lot of people would like to hear what that wake up call [00:13:00] actually was. 'cause it seems like up until that point. You're thinking of people as what numbers? Because otherwise how do you sleep at night at this point in your career? Right? Yeah. That begs another question. How do insurance companies justify policies that deny care to patients who desperately need it?

What's going on when it's like, this girl has leukemia, but it's like, how do they make that policy and justify

Wendell Potter: it? They have set themselves up and we as Americans have gone along with this as being the way it has to be. Insurance companies have established themselves as the ultimate decider as to whether or not you'll get a procedure, a treatment, even a medication, because they are the ones who presumably can make a determination as to whether or not something is medically necessary for you.

So they have inserted themselves squarely between you and your doctor. This was not always the case, certainly was not the case at all when I was younger. I. But it has become the norm, the routine, and most people have grown up with this system thinking this is the way it needs to be. [00:14:00] But you have, in many cases, an insurance company employee could be thousands and usually is thousands of miles away from where you are and where your doctor is making a call as to whether or not you're gonna be eligible for coverage for something that could save your life.

Whether we're talking about a cancer treatment or a transplant or something like that, it's usually the big ticket items, but not necessarily, sometimes they'll nickel and dime you to death because these companies have millions of people enrolled in their health plan. So every nickel, all that adds up, but it's mainly when someone gets sick.

Most of us in a given year, thank goodness, are relatively healthy. We don't test the limits of our healthcare plan and don't go on vacation. Go to Hawaii and have something happen to you. Things do happen to you ultimately, but they get away with what they get away with because I. In a given year, most of us think we're gonna be just fine.

If I get sick, if I get injured, I've got good health insurance, no problem. [00:15:00] Until they do get sick or injured and find out they do in many cases, have a very big problem. So tell

Jordan Harbinger: me about this wake up call that you had, this horror story that finally made you, I don't know, lose enough sleep to quit. Is that how it happened?

Wendell Potter: Yeah, there, there were actually a couple of things that happened within a few months of each other. I grew up in Tennessee and I went back to visit family in the summer. It was in July. And I, uh, picked up my hometown newspaper where I had actually worked as a young reporter, as an intern. There was a store in the front page that said that there was a big outdoor healthcare clinic that was being held a few miles from where I grew up at a county fairgrounds.

And I was curious. I've been to county fairgrounds all my life growing up. And they said thousands of people were expected to converge on this county fairground in Wise County, Virginia. I grew up in that part of Tennessee that's right up against the Virginia State line. I went there outta curiosity. I borrowed my dad's car and drove there because I'd never heard of anything like [00:16:00] this, and I can't tell you, it was almost like there was some divine intervention that drew me to that story and compelled me to go to this place as if I needed to see it.

I've often said that the road between Kingsport, Tennessee and Wise County, Virginia was my road to Damascus because when I got to that fairground site and walked through the gates, I saw something I just couldn't imagine ever seeing, witnessing in this country. There were people who were lined up by the hundreds and many lines, and they were soaking wet because it had been raining before I got there.

They weren't about to leave their place in line. Many of these folks had spent the night, sometimes two nights or more in their cars waiting for this event to start. And many of them I found out later, by the way, had health insurance. But what I saw when I paid attention to these lines was that in many cases they were leading to animal stalls.

Volunteers had [00:17:00] cleaned up the animal stalls. This was the county fairground, and just weeks before they, you know, they had prized horses and pigs in these animal stalls. They had doctors who were volunteering their times and nurses treating people in animal stalls. And it just did something to me, I couldn't believe that I was seeing it, that this is what so many Americans had to resort to, to get the care that they needed.

I came to realize almost instantly that I had to accept some responsibility because what I did for a living, I. Was to mislead people about our healthcare system, about how it operates and to make people think that it has to be this way. Doing this for the benefit of our investors for quite a long time, my top job objective was to enhance shareholder value.

So even in my job, that was job number one for me. What I was measured on. At first, I thought, well, what's wrong with that? Till I saw people face to face and then I realized what's [00:18:00] wrong with that? I. Because what I was doing for a living was making it necessary for people to get care that way.

Jordan Harbinger: If you told me that was happening in fairgrounds in Gaza or Ukraine, I would say, well, that makes sense.

It's a war zone, but when it's rural United States, we need to go sleep in our car at the fairground because we need medical care and it's gonna be in the horse stall, but they brushed all the crap out and put a blanket down. So it's fine. That's just like we are living in the third world, unless you have a ton of money.

And I'd love to hear about some of the shocking practices that you witnessed that the public might never expect. I've experienced a little bit of this. For example, I've two small kids. When we were looking into giving birth at the hospital for my wife, of course we looked into midwives and doulas and stuff like that to make it a little bit easier, and they were like, Hey.

You're super healthy, you're young, you're low risk. You should give birth at home. And I was like, look, we are not this kind of hippie. And they said, nah, here are the statistics of complications in hospitals and here's the experience and they're gonna rush you [00:19:00] outta the room. They're gonna rush you into the room first.

They're gonna induce you even if you're not ready. I. Then they're gonna rush you out 'cause they want another person to go in that room literally a few hours later, or the next day or the next night. That's their profit motive. But if you're at home and you start having labor pains at 11:00 PM ah, we'll just wait until the baby's ready.

And so we literally just paid the midwife doctor and doula to have the birth at home. And we told the hospital, which was close by, to be on standby in case anything happened. It took a couple days, right? But meanwhile, if we'd went there, it's like, well, they induce you, then they've gotta do a C-section because the baby's not actually ready.

These kinds of little things that give the hospital more profit result in massive operations suffering expense for the patient. That was just one. But I am quite sure that there are lots more that maybe the average Joe who's having a couple of kids doesn't actually experience.

Wendell Potter: I think that's exactly right.

And even the insurance industry plays some role in what you were describing there. Early on in my career at Cigna, we got a lot of bad [00:20:00] publicity because the company began to implement a policy of refusing to pay for more than 24 hours in the hospital for a delivery or a mastectomy. The media at the time, and this was in Connecticut, started calling this drive-through deliveries and drive-through mastectomies.

The insurance industry had decided, or my company had decided that new mothers didn't need to stay in the hospital more than 24 hours. It was perfectly fine for them to be discharged and go home, and there were a lot of OBGYNs who were balking at that, and that's what made it initially a local story, but ultimately a national story.

That was because of pressure from the insurance industry, because the insurance industry didn't want to pay for more than 24 hours for a new mother in the hospital, regardless. Now. The company said, those are just guidelines that's not set in stone. But that was the expectation and that's what would happen to you unless you or your doctor went to the trouble of objecting [00:21:00] and saying you needed to have more time in the hospital.

Jordan Harbinger: Geez.

Wendell Potter: But hospitals where we spend most of our healthcare dollars, it's extraordinarily expensive. And we've seen in recent years, hospitals combining becoming these massive businesses of their own. It's not just a single hospital anymore. Any hospital in the country almost is always now a part of a big system.

And they started doing this, in my view, largely in self-defense because insurance companies, like the ones I work for, began to consolidate and become massively bigger. And they did that on my watch. I managed a lot of communications around the acquisitions that my companies made. Hospitals decided if they're gonna play this game, we have to play that game too.

We've gotta get bigger to be able to negotiate in a reasonable way with these guys. And so you've had this arms race that has been going on now for several years as insurance companies got bigger hospitals combined to bulk up, and it's [00:22:00] all about the money. It's all about who can get the most money. Dr.

Jordan here, you

Jordan Harbinger: are going to die when you hear about the great deals on the fine products and services that support this show. We'll be right back. This episode is sponsored in part by Dell and Nvidia. AI is everywhere now from your inbox to your car. Even how your coffee gets made in businesses, they are scrambling to keep up.

So if you're not integrating AI into your systems, you're falling behind, or at least that's kind of the fear. Healthcare is no exception. In episode seven of the Cybersecurity Tapes, a major medical network Fast tracks a generative AI system to streamline patient logistics and gain a competitive edge.

But here's the thing, when you rush AI without fully understanding the risks, things can go sideways fast. Ambulances are rerouted, patients are delayed, systems are overwhelmed, and in this case, it could have caused lives. The Cybersecurity Tapes is a podcast that I really enjoy. It dramatizes these high stakes scenarios.

Based on real cybersecurity failures while also breaking down what went wrong and how to avoid it. So check out episode seven of the [00:23:00] cybersecurity tapes and see just how wrong AI can go when the pressure to keep up overtakes the need to play it. Smart. I. This episode is sponsored in part by design.com.

Alright. If you're starting a business or even just thinking about it, let me tell you about design.com. It is an amazing set of tools that makes creating a professional looking logo super easy. All you have to do is type in your business name and industry and in seconds it generates thousands of custom logo options for you to choose from.

And these aren't generic kind of meh designs. And it's not that thing where like people in Uzbekistan, no offense, create 8,000 different designs that just kind of look like the Uzbekistan flag, but with your logo somewhere or whatever. These are handcrafted by top designers from around the world. And once you find a logo that you like, you can tweak it, change the font colors, layout until it's perfect, then download everything you need to make your business look polished and ready to roll.

And design.com is even more powerful than that. You can generate templates for social media posts, ads, business cards, even websites, and way more. If you already have a logo, you can upload it and instantly get access to thousands of design templates that actually match your brand's look and color [00:24:00] scheme.

So the tool saves you a ton of time. It lets you focus on growing your business. Instead of getting stuck in the weeds with marketing materials, they've got a 4.8 star trustpilot rating. So design.com is legit amazing. It's run by a friend of mine. I know a lot of you always say like, oh, you always say that.

It's always run by some friend of yours. It strains credibility. What can I say? I got a lot of friends. I'm a popular guy. Okay. We know that part's not true. But anyway, I've known Alec for a while. The company's been around for a long time. They really do care about their customers. Try it for free at design.com/jordan.

If you're wondering how I managed to book all these amazing folks every single week, it is because of my network. The circle of people I know, like and trust. You're probably not booking for a podcast, but it doesn't matter. You need it in your personal life. You need it in your professional life, and we know from relationship science that those who live longer and happier have a strong network, that circle of people around them that cares for them and that you can care for yourself.

This course, six Minute Networking teaches you how to build that and how to maintain it in a few minutes a day. It is not cringey, it's not sort of mechanical stuff. It's quite fast. Just some tips and tricks I've learned over the past couple decades and many of the guests on the show [00:25:00] subscribe and contribute to the course.

Come on and join us. You'll be in Smart Company where you belong. You can find the course again for free. No tricky, weird stuff. I don't need your credit card information. For example, you can find the course@sixminutenetworking.com. Alright, back to Wendell Potter. There's some tales in the book that are just wild.

One example I think was reinsurers, which are essentially insurance companies. Of insurance companies. I guess they're trying to cancel people's insurance by trying to find things that people didn't disclose. And the example, and tell me if I made this up or if this is in the book, but the example was, we won't pay to treat your cancer essentially, because you never disclosed that you had heartburn in the past, which no one is going to disclose that.

Nobody's gonna necessarily remember that maybe they went to the doctor about it once five years ago because it got really bad. But then you know it's gone and then you get cancer and it's like, oh, well you didn't say that you had this. So it's a preexisting, I mean, this stuff is insane. This is absolutely crazy.

There's also this concept purging. Tell us how this works.

Wendell Potter: Purging occurs [00:26:00] when a company like Cigna looks at its book of business and decides that these people are no longer profitable, they're using too many healthcare goods and services, so they're sick, they're gonna the doctor more often, right? But also businesses, particularly small businesses that are trying to provide coverage to their workers.

If one employee of a small business gets sick, then that will mean that when the policy comes up for renewal, at the end of the year, the insurance company is likely gonna say, you had one sick employee that costs us a lot of money, so we're gonna raise your rates significantly for next year. And if that happens fairly often or significantly, and the insurance company is having to pay out more than the underwriters had initially thought, they'll jack those premiums up more than that employer can afford.

And that's why you have fewer and fewer small employers in this country able to offer coverage. It's dropped over the years [00:27:00] significantly. A lot of people are employed and they work for small companies, and those companies are just no longer able to stay in the insurance game. They can't offer benefits like they did 10 years or so ago, and that's been very prevalent.

Once again, it's all about the money. These companies are always looking to see how much they're having to pay out in claims, and they know that investors do not like that because the more they pay out in claims, I. The less is available to reward their shareholders.

Jordan Harbinger: Yeah. The whole employers paying for your healthcare thing never made any sense to me.

So if I'm unemployed now, I don't have healthcare. Also, it seems like that's when I might need it the most. Or maybe I'm unemployed because I'm sick. I mean, none of this makes any sense. And then of course my employer's like, gosh, how can I do this the cheapest way possible? That's not gonna result in good healthcare for anybody who's there, unless you're in the C-suite and they have to say, Hey, we've got the best healthcare in town, so come work for us.

If you're bagging groceries at Target, they're just gonna go either we don't offer this at all For your level [00:28:00] or Yeah, you've got what's below bronze plan, right? If you go to the doctor and it is, you're gonna pay for the first $50,000 of expenses out of pocket, and if you get hit by a car, we'll cover 10% of it.

I mean, it's just gonna be crap. None of this makes sense in developed nations. The world overall have nationalized healthcare, and I'm not one of those people who's like, the government should control everything. I'm the opposite. But man, even underdeveloped countries have nationalized healthcare in some way, and we could have two tiers.

You wanna pay out the nose fine, you could have a little better care, but like why are people just having no care whatsoever? The results are similar. When I was in that emergency room in Hawaii, I. I can almost promise you by, just by looking around that I was the only person who paid a bill after that. I don't wanna be rude about it, but the people who were in there, these were not people who had $4,000.

I think I might have been the only sober person in the ER that day. There was a guy who didn't even know where he was, and it wasn't because he was old and senile, it's because he had consumed whatever he had consumed for a long time. We had a swollen leg as a result, probably [00:29:00] fell. It's just one of those things.

So we're paying for this anyways. We're just paying for it in the most inefficient, ridiculous manner possible. I was looking at some history in Germany, Otto von Bismarck, who was, let's say what, a hundred plus years ago. He wanted nationalized healthcare because he said, Hey, the backbone of a strong working class is gonna make Germany strong.

No country can be strong, whose citizens are sick and weak and poor. This is over a hundred years ago. This guy was like, Hey man, I think we should look at this, and we still haven't managed to even eke out assemblance of this. It's insane to me.

Wendell Potter: Germany's to this day has one of the best healthcare systems in the world.

And it's not a pure single payer government run system either, but they do have a mechanism of making sure that everybody has coverage. That's critical. What you were describing, and I know it's right, you can go to any ER anywhere in the country and you'll find a similar situation. You'll find people who are there, you know that they're not gonna have money to pay out of pocket.

In fact, 40% of Americans have fewer than 400 [00:30:00] bucks in the bank. That's right. I forgot about that. And how can you expect them to pay up to $10,000 outta their own pocket? In many cases, people have that kind of exposure before their coverage kicks in. Most of us in this country have coverage. We're not at universal by any means.

About 92% of us have coverage just fairly close. But with a country this big, that means we have about 30 million people who still don't have insurance for one thing. They get sick, they go to the hospital and we are having to pay more in premiums and taxes because of that. But then you have this other situation of people who have insurance, but they have these high out of pocket deductibles they have to meet before their coverage kicks in.

They don't have that money either, even though they and or their employers are paying premiums when they get sick. If it's a big bill that they have to pay outta pocket, they can't do it.

Jordan Harbinger: Yeah.

Wendell Potter: So the rest of us are having to pay for it. It makes no sense whatsoever. Our employer based system began [00:31:00] accidentally, it was during the World War II era when employers were trying to figure out how they could attract scarce talent.

They began offering healthcare benefits and it just took hold. And that is where the majority of us still, if we have private insurance, get it. But that's eroding as well too. That's not growing either because small employers can't participate in this anymore and even large employers is saying this is not sustainable.

It's bound to collapse at some point. It's just a matter of when, in my view,

Jordan Harbinger: it doesn't make sense. You wanna attract talent, feed 'em lunch and put a gym in the place. Don't say, oh by the way, we're gonna pay for your kidney transplant. Should you ever need one? I do not wanna rely on my job at LinkedIn. Or, who knows at Ford.

So, oh, I remember one of the other insane examples of refusing to pay for something to cut costs. There was a girl, she was deaf, I believe, and had needed cochlear implants, and they said she's got one already. So you're gonna let her walk around with one [00:32:00] ear that hears. Are you insane? Who's the person in the meeting?

That's, I have an idea. That person is a psychopath. You really almost have to be a psychopath to go, this person needs a kidney transplant, both kidneys, because I heard you can survive with just one. You can survive with just one. All right, then denied. Who is that person?

Wendell Potter: That person will always be anonymous.

You will never know who that person is. By design, that person remains anonymous. You'll never know the person's name. That particular little girl who needed the cochlear implants, she was insured by Cigna. One of the jobs that I had was to discredit Michael Moore. When his movie Sicko came out. I had to know what the movie was about.

So I flew from Philadelphia to Sacramento to the first screening of that movie to know how Cigna was being portrayed, and that was one of the cases that was in the movie, and I knew it was a real one. And you're exactly right. Somebody at the company had decided, well, this little girl can get by with just one, [00:33:00] even though she needed to, she can manage with just one.

This happens all the time because these people can remain anonymous and they're so far removed. They never examine the patient. They might see some paperwork, or at least something scanned to them, faxed to them, whatever. In many cases, it's still faxed. But they're at such a distance. They have no real understanding of what that patient is going through.

Jordan Harbinger: I'm not justifying it, but this is one reason why the CEO of UnitedHealth got killed by Luigi Mangione because

Wendell Potter: how

Jordan Harbinger: much

Wendell Potter: was that guy getting paid? It was like tens of millions of dollars. Yeah, this is typical, and that was another thing that I had to handle when I was at Cigna. Executive Compensation and big companies have to disclose what the top paid executives are paid and the compensation is extraordinary.

Here's the other thing about that 90%, and this was a talking point that I used, and reporters bought it and thought that justifies the big paycheck. 90% of his compensation, I would say, was at risk. [00:34:00] In other words, he was paid in stock grants and stock options. When you step and think about that, that means that he's more beholden to Wall Street to these investors than anybody else and the company.

So his motivation is always to make sure that those shareholders are happy. If the company reports earnings that disappoint Wall Street, then your net worth is going to decrease. This guy, Brian Thompson, who was murdered, was one of the top executives in similar deal. You're paid primarily in stock, and he was in New York that day on December the fourth at United Health's Investor Day.

It's something I used to plan for Cigna. It's the day that the top executives go to New York City. It's really a kind of a dog and pony show with the biggest investors who persuade them that the company's in great financial shape and the future is bright. And that's what he was in New York to do, was to spend a day with the top shareholders of the company.

Jordan Harbinger: Yeah. I heard [00:35:00] also, and I look, I'm not trying to slander a dead guy here, but it looks like he manipulated some share buybacks, which is where you use company money to buy back shares to raise the share value and ended up backdating something. And he made a ton of money off those options, and I think he may have even gotten sued by the investors or something and had to give back some money.

There was some controversy there too, but for me it's just this dude took a bullet in the back of the head or whatever it was, because he basically just died for money. That's really all it was. In many ways. It's a

Wendell Potter: shame. It is a tragedy. You're right. He was under investigation for something along the lines that you described.

The CEO of United retired, oh, it's been more than 15 years, but he was in the news because he was found to have backdated some shares to inflate the value so that he would get more money when he cashed out, and he was forced to give back about a half a billion dollars that he had hoped he could walk away with, but he was manipulating the dates so that he could [00:36:00] maximize.

His payout,

Jordan Harbinger: and that means that he was not spending that time figuring out how to give better healthcare. He was sitting around screwing around with Google Sheets or Microsoft Excel or whatever it is to figure out how he could maximize his compensation. These guys, they're not working for us in any way at all.

They're working for themselves, they're working for the shareholders. This job should not exist. Should not exist at all. I'm not saying nobody has to run a company. What I'm saying is that he should be figuring out how to make healthcare cheaper, how to negotiate bigger. Look, $500 million is a lot of cochlear implants for little kids who need 'em, right?

But he would rather, I don't know, put a shiny hood ornament on his boat or whatever. It's just disgusting. Honestly. That's why I think so many people were behind this guy Luigi, like, look, murder is bad, but man, how many deaths is this guy responsible for with all his shenanigans and screwing around? Look, I'm not saying he deserve to die, but I can completely understand why somebody killed somebody like this and why there's gonna be more of this.

Wendell Potter: And keep in mind, you're dealing with people day in and day out who have medical issues. In many cases, [00:37:00] mental health issues. Sometimes they're associated with the pain and agony you've been going through. And this seems to have been the case for this particular young man, but it's becoming increasingly impossible to deal with these companies if you've been denied something.

And we saw that just triggered this outpouring of storytelling. On social media, people going to social media, sharing their stories, their horror stories with the world. And it was stunning how fast that began to develop. I wasn't shocked when I stepped back and looked at it because even when I was in the industry, I knew that people despised our industry.

We spent an enormous amount of money, and these companies still do on image advertising and product advertising, but we did surveys and we would ask people, what can we do to get you to like us better, essentially? And it was always the answer was, pay our claims and get out of our lives. But they can't do that and satisfy Wall Street, so they've got to do what they [00:38:00] do.

That's right. How about we just get outta your life without paying the claim. Meet you halfway.

Jordan Harbinger: No,

Wendell Potter: there you go. That's right. Yeah. If you die early, okay. It's not bad. Not a bad deal for us.

Jordan Harbinger: I've got a couple of friends, one of 'em, he had a tumor on his leg and it started growing and I don't remember all the details, but it was like, Hey, this isn't right.

Oh yeah, we'll do a test. Oh, you know what this test says we need to do another test. Great. Let's do it. Yeah. It's gonna take three or four months. What do you mean? Back and forth. And finally she said, look, this thing is continuing to grow. We're documenting everything. I've got all my calls recorded. I've got all my emails saved.

I've got all my letters saved. If he dies, I'm going to the media. And they were like, oh look, you can take that test on Monday. Wow, that's cancer. We better shoot radiation at that thing Done. He's fine. That really makes me think the squeaky wheel gets the grease in managed healthcare. So glad you said that.

Does this mean if I get a denial someplace, I need to go on this podcast and just basically shit, talk an insurance company, because I will do that if I have to.

Wendell Potter: Do that because some version of that is what [00:39:00] you need to do. I've told people whenever I have a chance, be a squeaky will. The problem is when you're really sick, it's hard to be your own advocate.

It's hard to be that squeaky will. You've gotta find the energy somewhere to do it. It's good to have an advocate, someone you know, someone and your family or a friend to help you with this when you're not at your best. But yes, be a squeaky will. There was one story in particular, one horror story that was it for me that I ultimately turned in.

My notice involved a girl in Southern California who needed to have a liver transplant, and Cigna medical director, 2,500 miles away in Pittsburgh said he didn't think it was medically necessary for her. Even though the surgery was scheduled, a liver had been found, the family had arrived at the hospital to wait for the procedure, but instead the parents were taken aside and said, sorry, we can't go for, because Cigna.

Has not given us clearance to do this. Long story short, the family [00:40:00] decided to make a big deal out of this, and they were able to get reporters in LA to start calling me. So, what's the deal here? Why is Cigna not paying for this girl's transplant? And it just mushroomed, it became a huge PR problem for the company.

These companies don't like it and they have people like me on staff who dealt with these day in and day out, and they do want these stories to go away. So more often than not, when a reporter calls somebody in the media, probably someone with a big social media following these days, that can make a difference because these companies want to try to make these stories go away.

And they often will

Jordan Harbinger: reverse a denial. That's so interesting. And also really crappy at the same time. Because what this is showing, and by the way, this girl, I think her name was Lene, so they didn't approve it and then they gave the liver to somebody else because Cigna was sitting on their ass for so long that she didn't get the liver in time.

And so reversing that denial. That's great. Good for you, Jordan, with a huge podcast. What about for people who don't [00:41:00] do media for a living and have success internationally with a giant footprint? Oh, well you're just outta luck. My kids get to live and yours are screwed because you're an engineer somewhere That hardly seems fair.

And what it also shows is they'll reverse the denial because they know it's bullshit and they know it's unfair, and they go, wow, this makes us look like the assholes that we actually are. We should probably say that this was an administrative error and turn it around. But this is an exception to the rule and we can afford to do it only because wow, our people pissed off at us, and that's gonna reflect poorly in the stock price and we're gonna have to spend a lot of time fighting it in the media, or it's gonna come up in another interview when our CEO is interviewed by Squawk Box or whatever.

If that's what has to get done, it's even worse because it's like, yeah, we're doing bad stuff. We hope that we can cover it up, but when it does leak out, we'll just make it look like an accident and then go right back to doing the exact same thing to everybody else who couldn't get their name in the paper

Wendell Potter: is exactly right because the vast majority of us.

Don't get our names in the paper, [00:42:00] we don't know you. We don't know how to get on your show. We don't know how to do these kinds of things. It's only the occasional ones that really break through that can get a reporter interested in taking your case and making a call on your behalf. And they get away with this day in and day out because people don't know how to be a squeaky will.

I say, give it a go. Do the best you can, but that's hard. It's hard to do that, and you're facing such odds. And I always encourage people to never take no as your first answer. Always begin an appeal process, but the industry makes it so damn difficult. A lot of people don't know that they have rights to appeal.

They just assume it's gonna be such an ordeal, or they feel so lousy that they don't do it. As a consequence, a small percentage of people actually fight back. They never file an appeal. They don't become the squeaky will and they suffer, and in many cases die early. It's the way it is. [00:43:00] Tell

Jordan Harbinger: me about the lobbying and the politics.

What is astroturfing? What are you creating here with these sort of front groups to be against policies you don't like? If you're an insurance company,

Wendell Potter: you're essentially inventing groups that purport to be consumer organizations or patient organizations that are nothing of the kind, but you name them in certain ways to make people think they're legitimate.

One in particular that comes to mind that I was a part of, we called it Healthcare America. We created it for two reasons. One was back to Michael Moore. We set it up to discredit him by having this outfit, which was run by a big PR firm in Washington, that people thought there might be some real consumer folks involved within it.

There was nothing of kind, but it turned out press releases. It would get quoted in the newspaper. Saying that Michael Moore was outta step with American society. He was advocating for a government takeover of healthcare, [00:44:00] things like that, just to discreet out a movie. But when Congress got down to business to try to pass healthcare reform legislation in the early days of the A Obama administration.

We repurposed that front group, healthcare America, to try to get Americans to believe that what was being proposed would not be in their best interest. It was paid for exclusively by big insurance companies. But Americans don't know that. You see these advertising, you see, see things on TV, particularly during election years, and think that whatever that advertisement is from some legitimate organization, more often than not, it's some industry that has found some name and some outfit that they create and pay for and hire a PR firm to run that's behind

Jordan Harbinger: it.

I remember hearing that Obamacare was gonna have death panels and there'd be people that would decide whether you live or died. And then I remember hearing people in Congress say, there's gonna be death panels. They're gonna decide who lives or dies. [00:45:00] And ironically slash diabolically, the healthcare companies have these pretty much already.

And that's the problem. They would actually be going away in many ways under Obamacare's or the A CA. But healthcare companies were like, oh, what are people afraid of? Some random person 2,500 miles away deciding whether you can live or die. Yeah, we already have that. Let's just say that's what they're gonna do.

If you vote for this thing, it's gonna make us less money. And it's like, all right, great. Dust off the logo from the bullshit thing we did in the nineties or whenever Sicko came out in the early aughts. It's really gross. How much lobbying and politics influences decisions made by Congress, but also healthcare insurers.

I noted in the book you mentioned an acquaintance of mine, mark Geragos, who was trying to sue Cigna and he was unable to do so because there's a law that basically says you can't sue healthcare companies and states can't protect consumers against them. Tell us how this incentives kind of work because it, it almost looked like the incentive was insurance companies decide if they wanna pay and it's [00:46:00] actually better if you just die and then they don't have to.

Or am I misreading that

Wendell Potter: it, it's ridiculous. And it goes back to what we were talking about earlier about employers providing access to coverage. There's this law that was passed in the mid seventies to protect people's pension benefits, make it unlawful for employers to abscond with your retirement money.

It's been interpreted over the years to apply to health benefits, and it gives employers enormous protection from state laws. It makes them exempt from state laws, but it also makes it impossible for people to sue an insurance company or an employer and have much chance of recourse because the law says that all you can get is maybe a decision that the benefits were not administered correctly.

So consequently, very few lawyers will take this case on, and I think Mark Geragos didn't fully appreciate the protections that employers and insurance companies have because of this [00:47:00] law. And he was not able to get any money for this family.

Jordan Harbinger: It was Ned Lean's family. He was involved in that case. That does not surprise me.

I was gonna say it's really thick and twisted in that an insurance company can say, Hey, we didn't pay for your treatment and then you died. But you would have to prove that you died from that thing that we didn't pay to cure. And if you can't prove that, it's not our fault. And not only can you not sue us, you paid us premiums and then we denied your coverage.

So we actually made out pretty well not paying for your cancer coverage. Now you gotta prove that you died from that cancer. Well, it says here, you died from cardiac arrest and sepsis. Maybe the cancer caused that, but uh, can you prove that? No, you can't. So go, you know, fly a kite. That's

Wendell Potter: what it sounds like.

Now you see why these companies make so much money, how they're able to bait their CEOs 20 plus million dollars every year and report profits of one company like $30 billion a year. It's just stunning how much money they're making.

Jordan Harbinger: Sorry, we can't get you that critical liver [00:48:00] transplant. But rest easy because I can get you some deals and discounts on the fine products and services that support this show.

How about a mattress or something? We'll be right back. This episode is sponsored in part by Better Help. Let's Be Real. Therapy used to carry a ton of stigma. People thought it meant something was wrong with you, but well now we know better. Taking care of your mental health is just smart. It helps you build tools, set boundaries, handle situations better.

Overall, still one in four people avoid therapy because they're afraid of being judged. That has really gotta change better help, makes it easy to get started. It's fully online, it's affordable. It matches you with one of 30,000 licensed therapists, and if the fit's not right, and that's happened to me before too, switch anytime, no extra cost.

Over 5 million people have used it. Jen and I, my parents have used it. It's helped so many navigate through life Transitions difficult times. So if you've been thinking about it, even just a little, go ahead and check it out. The world's a better place when we're all a little more tuned in, especially to ourselves, a little more supported and a lot less afraid to ask for help.

Jen Harbinger: We're all better with help. Visit better help.com/jordan to get 10% [00:49:00] off your first month. That's better help hlp.com Jordan.

Jordan Harbinger: This episode is also sponsored by Shopify. You ever try to buy something online and wonder why it's so dang hard to give 'em your money? There's a clunky checkout. You gotta make an account or something.

You log in, you gotta enter your password. What was the password? Reset the thing. It's a mess. For real. This happened to me recently where I thought to myself, it's too bad this company's not using Shopify. 'cause I don't have half the afternoon to deal with this when it's smooth. That is Shopify working in the background.

That purple shop pay button lets you buy without even thinking Shopify baby. Once you know, you know, if a store isn't running on Shopify, I'm already 90% out the door. I'm not here to solve a freaking puzzle and verify that I'm not a robot to buy a t-shirt, folks. And here's the thing. Shopify's not just making shopping better, it's making starting your own business way less painful too.

Whether you're trying to build the next big brand, or just finally launch that side hustle, you keep talking about Shopify hands, you the keys templates ready to roll. AI tools to speed you up. Marketing tools baked right in. So easy to hit your store off the ground. So if you're ready to sell, do us all a favor sell on Shopify.[00:50:00]

Jen Harbinger: If you wanna see less carts being abandoned, it's time for you to head over to Shopify. Sign up for your $1 per month trial and start selling today@shopify.com slash Jordan. Go to shopify.com/jordan shopify.com/jordan.

Jordan Harbinger: I've got homes. Dot com is the sponsor for this episode. homes.com knows what when it comes to home shopping.

It's never just about the house or the condo. It's about the homes. And what makes a home is more than just the house or property. It's the location. It's the neighborhood. If you got kids, it's also schools nearby parks, transportation options. That's why homes.com goes above and beyond. To bring home shoppers, the in-depth information they need to find the right home.

It's so hard not to say home every single time. And when I say in-depth information, I'm talking deep. Each listing features comprehensive information about the neighborhood complete with a video guide. They also have details about local schools with test scores, state rankings, student teacher ratio.

They even have an agent directory with the sales history of each agent. So when it comes to finding a home, not just a house, this [00:51:00] is everything you need to know all in one place. homes.com. We've done your homework. If you like this episode of the show, I invite you to do what smart and considerate listeners do, which is take a moment and support our amazing sponsors.

They make the show possible. All of the deals, discount codes, and ways to support the podcast are searchable and clickable over at Jordan harbinger.com/deals. If you can't remember the name of a sponsor or you can't find the code, email usJordan@jordanharbinger.com. We're happy to surface codes for you because it's that important that you support those who support the show.

Now, for the rest of my conversation with Wendell Potter, it sounds like big tobacco all over again, these front groups that you'd created. It's interesting, right? Your industry, your former industry, I should say completely lax credibility, so you really need these front groups to message for you because nobody freaking trusts you anymore.

It's interesting how these companies sort of whip up what sounds like mostly kind of older peoples. If you tell my parents that their healthcare is gonna suffer in some way, they're gonna be really upset about it. They're the ones who actually call their congressmen when something is wrong. I'm like, [00:52:00] wow, people do that.

I thought that was just something that you hear on the internet. Right. Pharma, insurance, politics, tobacco, that's what y'all have in common is nobody trusts you, so you have to be like organization for a more secure America. Secure for what? Well, we're talking about the shareholders, but nobody has to know that we mean secure and, and it sounds like something you should vote for.

Okay. It's like when you look at a. The ballot and it's Fair Education America, and it's like this group is just a bunch of old people who wanna pay less taxes. No. What? How is that fair? What are you talking about? It's just a bunch of crap. I'm a little bit fired up because it's really making me angry.

Just reviewing all this stuff all over again. These charm offensives, and you get a shady talk show host like Rush Limbaugh, who you know did untold damage and you just have them parrot your bullshit for you for money.

Wendell Potter: That's word. Exactly. You are able to throw money at influential folks to get them to carry your water for you.

You mentioned the tobacco industry. That was a playbook that we followed chapter in verse, and part of it is to [00:53:00] form these front groups. Because if your industry has no credibility, you've gotta have some outfit and some allies too. They will go to organizations like the US Chamber of Commerce and others that people hold with greater respect and believe our credible organizations that represent small businesses.

And I can assure you, the US Chamber is not quite that. We worked with the US Chamber and a lot of big organizations. We wanted to ally with them and let them carry our water for us because we couldn't do it ourselves.

Jordan Harbinger: What about the polls and survey data? You mentioned this in the book. Essentially they select certain people in a certain way and get the results that they want.

Tell me how this works.

Wendell Potter: Yeah. We were always constantly surveying people to find out what they were thinking about public policies. It pertains to healthcare. We would wanna make sure that we understood how susceptible they were to agree with the Michael Moores of the world. How likely are they to say that we need to go to a.

Single [00:54:00] Bayer healthcare system and our surveys showed even when I was in the industry, that a majority of Americans were okay with that. So our job would be to dissuade Americans to get people to fear that. And so our pollsters were also messaging experts, and they would also know how to ask some questions to get people to change their opinion or to see it from a different perspective.

And then that would enable us to do our talking points and to scare people in a certain way. For example, if you were to go to a Medicare for all or a single payer system in this country, by definition, it is going to be paid for with tax dollars. And every study you've ever seen will show that we can attain universal coverage in this country and pay less for it than the system we have now.

But you have to pay more taxes. So you would shift from paying premiums to private insurance companies. To pay more that would be dedicated to health insurance. [00:55:00] The insurance industry knew how to manipulate people to fear a tax increase. You would obscure the fact that they wouldn't be paying premiums to get them to be opposed to paying additional taxes.

So that's just an example of how you do that. You poll people to find out what they currently think and then you figure out how can you scare the shit out of 'em. How can you develop a messaging campaign to get them to fear what your opponents are advocating for?

Jordan Harbinger: It is gross and I can see why you had a crisis of conscience when it comes to this.

Do you think Americans are finally reaching a breaking point with the healthcare system? Because it seems like we should have a long time ago, but here we are still same old crap.

Wendell Potter: I do. It's hard certainly to sustain any kind of movement, if you will. When, uh, Brian Thompson was murdered, there was a lot of publicity around that.

I think there will be, as that goes to trial, I think it is not a dead subject by any means yet. But I am seeing for the first time, I think in my lifetime, more [00:56:00] bipartisan interest, at least here in Washington, to address some of these big problems. You're not gonna see Republicans embrace Medicare for all.

That's just not gonna happen. But they are beginning to pay attention to some of the practices of this industry and seeing how they're ripping off their constituents. So I'm seeing that, and in fact, I'll be meeting with every time I come to Washington with Republican offices because they run the town now, and I am seeing and hearing receptivity to doing something and working across the political aisle with Democrats.

To try to reform this industry. Will we reform it enough? Uh, it is gonna take a while. It's gonna be a while, but I do think that we, Americans are seeing this for what it is, seeing how it's rigged against us and how they're profiteering. And I think that will lead to meaningful reforms. I

Jordan Harbinger: do. Can we draw a straight line between the insurance industry and the rising cost of healthcare?

Because I think we've been hinting at that, but people are probably wondering, wait a minute, how come this insurance company that puts profits first, how come [00:57:00] they're making the actual cost of things higher? They don't set the prices? Or do they, I mean, how do those things connect?

Wendell Potter: They don't necessarily set the prices in other countries.

There is a national mechanism that does have some price setting and responsibilities in this country. We've taken an approach of essentially saying that's for insurance companies and hospitals and doctors to fight it out, and it has obviously hasn't worked very well for us because prices keep going up and up and up.

What people need to realize is that insurance companies don't have all that much of an incentive. To bring the unit cost of goods and services down because as it goes up, as a stay in the hospital goes up, as a prescription goes up, despite what an insurance company complains about, they benefit because they're the only game in town.

We don't have a public option. We don't have anything that really competes with private insurance companies. They're the only game in town. They all work as the cabal and they're able to raise premiums every [00:58:00] single year. The average cost of a family premium that you get through an employer is now $25,000, and that's not accounting for the out-of-pocket cost.

So that's how much a policy for a family cost, and that family can also be on the hook for $18,400 as a maximum out of pocket. So you can be paying all this much in premiums and all this much in out of pockets Also. So the way it is structured now almost guarantees that the cost of healthcare will go up.

Drug companies, hospitals, physician practices, they're gonna raise their prices because they know they can. These companies, the insurance companies don't have as much of an incentive as they would like us to believe to control those costs. What they do control or try to the lever that they often say that there are two ways to control prices.

One is to do something about the unit cost of goods and services, how much a drug costs or to limit [00:59:00] access to that drug or treatment. And that's where they're really good at. And they have said, it's our fault that we, we want to use too much healthcare, so we need to have more skin in the game. That was a phrase that sadly I helped get out there to get people to believe that people needed to pay more in deductibles because we were using, I said back then, too much healthcare.

It's nonsense. People don't. Necessarily love to go to the doctor. There may be some hypochondriacs, but there're few and far between people who love to go to the doctor, love to go to the hospital, and who do you know who takes unnecessary cancer drugs? It just doesn't happen.

Jordan Harbinger: That's insane. What advice would you have for somebody who's trapped in, let's say, medical debt and feels like, Hey, this system is stacked against me.

You mentioned appeals and stuff like that before. Is that where you start?

Wendell Potter: That's very important. It's where you start. Again, don't take no for an answer. If you get a bill from a hospital, call the hospital and call your insurance company and say, this can't be right. How [01:00:00] can this be the bill that I'm being charged?

'cause often, sometimes there is just an error. Or a clerical mistake, or the insurance company hasn't filed the claim yet, and so you're getting a bill from a hospital. Just don't pay that first bill. Start inquiring and appeal a denial. If you are told that the insurance company that you have is gonna be refusing to pay for something, your doctor says you need fight that, know what your appeal rights are, ask your doctor to help you because the doctor has an incentive to join you in this.

Doctors unfortunately are having to spend more and more time every day finding insurance companies to get approvals and to get paid appropriately, but you need to enlist them as well too.

Jordan Harbinger: What a waste of their time. Imagine you're a surgeon and you gotta spend three hours a week writing a letter saying, no, really, I need to take this person's infected.

Kidney out immediately. As a doctor, you gotta be sitting there looking at your computer going, how did I end up having to do this? [01:01:00] This is insane.

Wendell Potter: Yeah. They don't tell you that in in medical school, but that's the reality of their lives, and a lot of them are getting burned out. They're retiring early.

They're using this term moral injury to describe what it's like in many cases to be a doctor in America. I. It's crazy.

Jordan Harbinger: I don't even know what you would call it, but my parents have this and a lot of my friends have this where you have your insurance and you have your doctor, but then you pay like a yearly membership almost to your doctor.

And your doctor goes, all right, I'm basically dropping everybody who doesn't pay for this membership. So you're paying $1,500 a month for your insurance or whatever it costs, but then you're paying, I don't know, five grand a year or four grand a year to be on the list of the people whose phone calls get answered by the doctor.

I don't totally get what it is, but the way the doctors have justified it, 'cause I originally was annoyed and I was like, what the hell are you doing? What do you mean you're gonna charge my parents more? He goes, I'm not getting paid half the time by Medicaid or the insurance company. I'll give your parents the [01:02:00] medicine they need.

And then I go to bill it and they're like, well, actually, we're gonna give you 40% of this because of reasons. And so he just gets screwed and he is like, you know what? I'm only gonna take people that have good insurance and I'm only gonna take people who pay this, and that's gonna offset all of the nonsense.

And then I have some stability in my income and I'm not basically loaning the government or the insurance company my money, which I understand. I wouldn't wanna be a doctor like that either. Dealing with that nonsense.

Wendell Potter: Yeah, I know. And that is a growing thing that you described that used to be called concierge medicine.

I guess a more appropriate term from their perspective is direct access or something like that. And you can have quicker access to a physician in mental health. This has been happening for quite a long time. A lot of psychiatrists and therapists don't accept insurance because they don't get paid enough.